The price of gasoline, cigarettes and alcohol includes, among others, excise duty. The resulting income is a large injection of cash for the state budget, and for us it is a cause for complaints. You probably think that once the country was not so greedy? Nothing could be more wrong. The list of products subject to excise duty and related levies in the Second Republic of Poland is so long that it is difficult to quote it in full!

It was not easy for the taxpayer in pre-war Poland, and certainly not in the second half of the 1930s. At that time, the excise tax was levied on:sugar, beer, wine drinks, mineral oils, yeast, acetic acid, electricity, animal slaughter, and even ... silver and golden lighters and playing cards! In addition, there were excise duties for the Road Fund for:motor vehicles, buses, roadside advertisements and propellants. This is not the end yet, because the Labor Fund was also lining up for the taxpayer's money, for which the following could be - and often were - taxed:light bulbs, gas, shows and a totalizer.

Okay, but maybe it wasn't that bad, after all, there are no cigarettes or spirits on this list? Unfortunately, these are only appearances, because the state had another whip on the taxpayer - Monopoly Skarbowe (State Spirit Monopoly, Polish Tobacco Monopoly, State Salt Monopoly, Polish Match Monopoly and Lottery Monopoly). All products manufactured by them were subject to the monopoly duty, which corresponded to the excise duty.

So many theories, but what did the excise duties look like in practice?

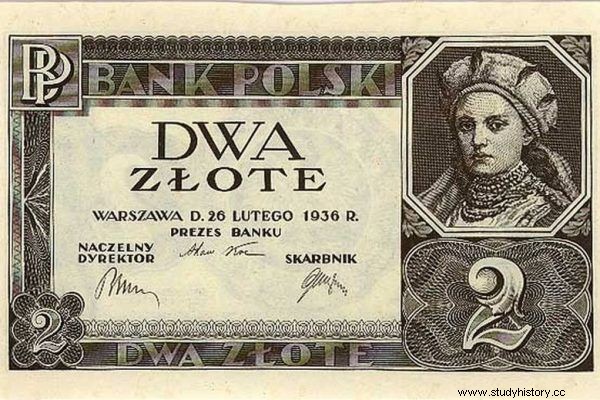

Enough of this enumeration, now it's time to take a look at how it all looked in practice. The first on our list was sugar, which in the period we are interested in retailed at about PLN 1 per kilogram (approximately PLN 10 today). Expensive, but no wonder, after all, the excise tax was as high as PLN 37 per 100 kg.

Simply put, the pre-war zloty corresponded to 9-10 the current zloty. So by multiplying the amounts given in this article by 10, you will get today's equivalents. It will turn out that, for example, a deck of cards could be subject to even a 100-zloty tax in today's currency, and a liter of solid beer was becoming more expensive by about one zloty due to the excise duty.

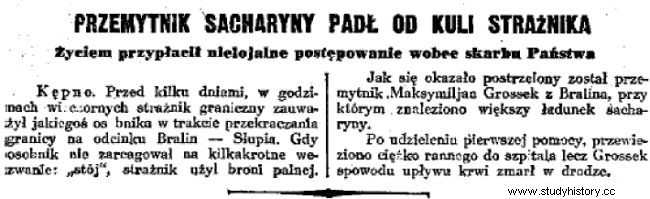

This translated into considerable budget revenues, which in 1936/37 amounted to PLN 118 million (more than at that time the budget was spent on road construction and maintenance!). It is also worth mentioning that in the twenty years, the sale of the so-called sweeteners only with the consent of the tax authorities. In addition, they could only be used for medicinal (diabetic) or scientific purposes. There was a risk of imprisonment for illegal trade.

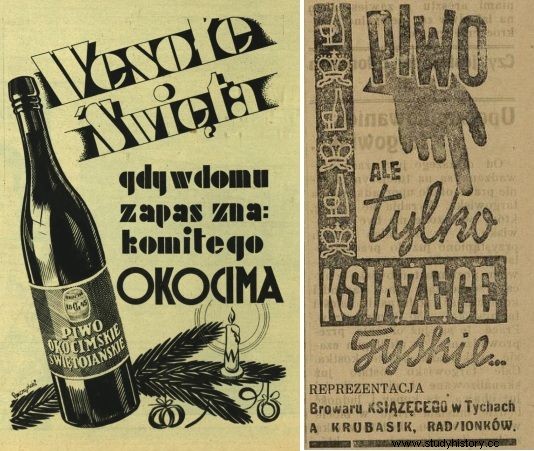

Another product from the "counting-out" was beer. In the case of a golden drink, the amount of tax depended on its "power" and the volume of production of the brewery (smaller ones were supported). And so, for a beer full the excise tax was PLN 8.30-9.20 per 100 kg, but the rate increased by 50%, respectively, with the so-called Double snipe and 100% strong beer.

Such fiscal policy translated into rather low consumption of this drink in pre-war Poland. This is evidenced by the low revenues that were transferred to the budget. They closed in the financial year 1936/37 with the amount of PLN 8 million. It is worth remembering about the anti-alcohol movement in Poland and prohibition in force in many localities.

You could even lose your life by smuggling in a sweetener! (Morning Diary)

Wine lovers also fell victim to the excise tax. In this case - as with beer - a lot depended on the alcohol content and whether the wine was grape or fruity. For example, a liter of grape wine with an alcohol content of over 10% was subject to a tax of as much as 2 zlotys, fruit wine 50 groszy. and saturated honey only 20 gr. Only wines produced for own needs (up to 100 liters per year) were free from excise duty.

This article has more than one page. Please select another one below to continue reading.Attention! You are not on the first page of the article. If you want to read from the beginning click here.

Do you play cards from time to time? In twenty years, when purchasing a deck to play, you would have to take into account a large excise duty paid at the stamp duty office. The rates ranged from PLN 1.30 to PLN 10 depending on the number of cards and the material they were made of. As it turns out, the players also supported the Polish Red Cross. This was because each deck was taxed for that purpose. If it counted up to 36 cards, it was PLN 0.40, in other cases PLN 0.60, and if the cards were made of a material other than paper, you had to pay "only" PLN 5. They liked to pop a bubble while playing the game. However, anyone who wanted to light a cigarette with a gold or silver lighter had to go to the proper office first. There, after paying the appropriate fee - in the amount of PLN 20 - an appropriate excise stamp was affixed and the lighter could already be used legally.

Beer! Cold beer! Cold beer with excise duty!

The drivers in the Second Polish Republic also had a hard time

Are you complaining about the excise tax in the fuel price? Because I'm complaining, but maybe I should stop, because in pre-war Poland the situation was even worse. Under the slogan mineral oils mentioned at the beginning, there was a long list of crude oil and natural gas products. The following were taxed:gasoline, kerosene, lubricating oils, petroleum jelly, paraffin, pool gudron, lubricants and gasoline. The rate depended on the density of the mineral oil and was divided into four categories, in the range from PLN 1.80 to PLN 14 per 100 kilograms.

Whether you prefer beer or wine, you have to pay! And the illustration shows a pre-war advertisement.

Do you think that road tax is an invention of our times? I must correct you, as early as in the 1930s there was a road allowance for the Road Fund in the amount of PLN 0.22 for each kilogram of mineral oil that could be used as a propellant. For this reason, for example, ethyl alcohol and benzene were also taxed. All this translated into a high price of gasoline, which in the 1930s cost about PLN 0.80 (i.e. approximately 8 modern zlotys). Such a fiscal policy clearly did not have a positive effect on the development of the automotive industry in the country, as evidenced by the fact that at the beginning of 1939, only 41,948 cars were registered in Poland. Therefore, the state's income from the road allowance was also not very high, amounting to PLN 21 million in the financial year 1936/37.

However, another expense was waiting for the potential owner of two or four wheels, namely the fee for motor vehicles, introduced in 1931. The rates for cars depended on weight, body type, and rim size. In this case, the excise duty was paid by the person for whom the car or motorcycle was registered. In the event of failure to pay the amount due, it was necessary to take into account that the registration certificate would be invalidated.

For the Road Fund, also buses and advertisements on public roads were subject to excise duty. While in the case of advertising, the revenues were symbolic, amounting to only approx. 24 thousand. PLN per year, bus owners paid 16 million PLN to the budget in 1936/36. From today's perspective, it is interesting that in the light of the law, horse-drawn vehicles were also used to transport people for profit. As you can see, the taxpayer at that time did not gain much ...

This article has more than one page. Please select another one below to continue reading.Attention! You are not on the first page of the article. If you want to read from the beginning click here.

Everyone eats bread, so why not introduce excise duties on yeast?

The rotating tax office also taxed yeast and acetic acid. Baked yeast was charged at 1.5 zlotys, and acetic acid at 40 groszy per kilogram. Due to the high consumption of bread, in the fiscal year 1936/37 alone, yeast producers and importers contributed PLN 16 million to the state treasury.

We have bread, so it's time for some cold cuts, but what is it… and here is the excise duty? Well, it covers the slaughter of animals. It is only comforting that the rates were not horrendous:cattle 3 zlotys per head, 1.5 zlotys per calf, and the same in the case of cattle. Fortunately, slaughter for personal use was free of charge, including exports.

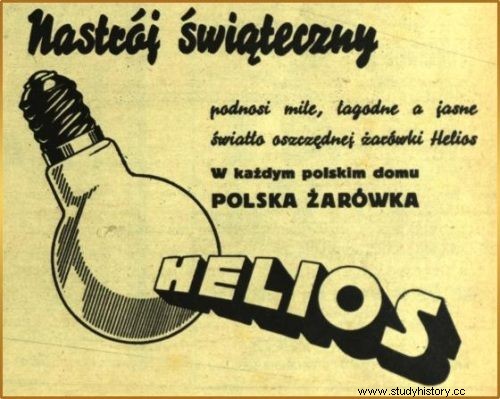

Install the bulbs! It's so cheap!

You shine is what you pay

The second half of the 1930s brought the electrification of an increasing number of households (mainly in larger cities), but here too our grandparents had a hard time. In addition to paying for the meter and the electricity used, they also had to take into account the 10% excise tax on the electricity used. If, on the other hand, they were (un) lucky enough to live in a large city (over 250,000 inhabitants), the municipal authorities could charge an additional 25% of the state excise for themselves.

Since we already have electricity in the house, maybe it is worth investing in electric lighting? Why not, but here again the state is asking for its own, and exactly 15% of the price of light bulbs for the Labor Fund.

A lot of it, and here are also state monopolies!

This is how we reached the end of the counting, but as you probably remember, there were also state monopolies. However, this is a topic for a separate article.